Insurance Restoration

EVERYTHING HOMEOWNERS NEED TO KNOW

INSURANCE RESTORATION

What is Insurance Restoration?

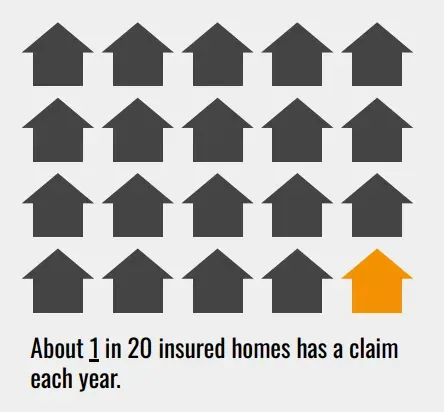

In order to deal with catastrophic loss, modern society developed a useful sharing model called property insurance. Homeowners pay for property insurance, yet may never file an insurance claim, while others less fortunate are able to tap into the collective pool of funds to help pay for their losses. In other words, insurance is a communal system which takes care of those affected by disaster, taking the worry of financial hardship out of the equation when it comes to catastrophic loss.

Insurance restoration is when an insurance company pays for the repairs by construction professionals on a home or business in the event of specific types of damage, often severe weather-related, as opposed to damage from normal, expected wear-and-tear.

Insurance Claims Glossary

Here are some of the main insurance claims terminology homeowners should be familiar with in the restoration process.

ACV Check

Insurance companies are expected to pay for the damaged items and cover costs to replace the roof. They will take the roof’s age into factor and give the homeowner an initial check for the ACV (Actual Cash Value) to replace the damaged roof.

RCV Check

Replacement Cost Value (RCV) is the amount it costs to replace your property with a new property without deducting for depreciation. If the homeowner has an RCV policy, they can get an additional check for the difference between the ACV and RCV check.

Deductible

This is the portion of the insurance claim that the homeowner is responsible for. It is considered insurance fraud for the contractor to cover or waive the deductible payment.

Insurance Claim

The insurance claim is a way for your insurance company to pay for the problems you’ve had and make sure everything’s covered.

Scope of work

The scope of work tells a story. It includes the work to be done on a project, why the work needs to be done, how the workers should complete the job, and what its going to cost. The insurance company will review the contractor’s submitted estimate and return a scope of work for everything they approve to be completed.

Depreciation

The term depreciation refers to an accounting method used to allocate the cost of a tangible or physical asset over its useful life or life expectancy. Depreciation value is often determined by the Property Loss Research Bureau, a third-party organization that performs all research related to insurance claims and loss.

Public Adjuster

The Public Adjusters main responsibility is to protect you and your interests in claims against a loss with the Insurance Company.

Insurance Adjuster

Adjusters inspect property damage or personal injury claims to determine how much the insurance company should pay for the loss.

Insurance Policy Basics

Insurance Policy Types

Homeowners insurance policies generally cover destruction and damage to a residence’s interior and exterior, the loss or theft of possessions, and personal liability for harm to others. In this manual we will primarily cover destruction caused by hail and wind to the exterior.

Insurance Policy Types

Actual Cash Value

ACV is the basic level of coverage. In simple terms, the insurance company pays out the value of what was damaged based on what it was currently worth, not how much the property owner paid for them. Claims under this policy have the depreciation deducted.

Replacement Cost Value

RCV is the more popular policy because it covers the ACV without deducting depreciation. This policy is recommended because it doesn’t just cover the value of the home, it provides coverage to rebuild your home up to the original value

Guaranteed Replacement

Guaranteed (or extended) replacement cost/value is the most premium, inflation-proof policy. It’s similar in structure to the Replacement Cost coverage, however this policy pays out whatever it costs to rebuild the home, even if its more than the policy limit.

Best Practices

Filing the Claim

We empower homeowner’s by educating them on their responsibilities in the claims process. The first task for homeowners is to contact the insurance company to kick off the claims process.

1. Post-Storm

In general, after any event that affects their home, the homeowner should take photos immediately.

➤ If possible, try to find some photos of the property recently before the storm, this will be a huge aid in the process later. ➤ The contractor will perform an initial inspection to see if the damage qualifies for a claim.

2. Review Policy

Every policy can vary. Gather together all your home insurance documents.

➤ Verify the coverage. The declarations page of the policy should have this information. The contractor should craft the estimate around the policy type. ➤ The policy will have the deductible clearly outlined, it is the homeowners only financial responsibility when the claim is approved.

3. Contact Insurance

➤ In the initial call, the homeowner will have to verify information and report the incident. Notate the claim number given.

➤ Notify the insurance company that you will be working with your contractor of choice on the restoration. Urgent emergency repairs can be addressed at this time.

4. Claim Paperwork

The insurance company will have the homeowner fill out additional paperwork regarding the claim.

➤ Remember, the contractor will help you provide a detailed report to submit to the insurance company. Don’t submit any documents to the insurance company without reviewing it with your contractor first.

➤ If you have suffered additional loss due to the same storm like personal belongings etc, you should document and report that as well.

5. Temporary Repairs

➤ The contractor will recommend temporary repairs or tarping be completed to decrease the likelihood of further damage while the roof is vulnerable.

➤ These initial repairs may need to be paid out of pocket while the claim is being reviewed, but they are very important to complete as soon as possible. The contractor will add these services to the claim and will fight to get it covered as well.

Insurance Claims Process

- INSPECTION

- FILE A CLAIM

- ADJUSTER MEETING

- CLAIM APPROVAL

- PAYMENT

- THE JOB BEGINS

When you notice that your roof has damage, don’t wait. Hire a trusted, highly rated roofing contractor to come to your property to inspect and thoroughly document damage needed for repairs or replacement purposes. We can help build a case with your insurance company, if the damage qualifies for a claim.

Your home insurance should cover storm related damage depending on your policy. We have extensive experience with insurance companies in our area. We understand the insurance claims process and can help walk you through it.

After your claim is filed, your insurance company will usually send their own representative to verify the roof damage is related to a covered event. A representative from our company will be there to assist, if needed, to make certain that your property is properly inspected.

After the onsite inspection and reporting, your insurance company will issue a judgement on the claim. With our thorough insurance restoration assessment, your roof restoration costs should be effectively covered and approved. If not, we will take further next steps to qualify you.

When the claim is approved, we just need to collect your deductible, if you have one with your policy. This is a fee that cannot be covered by the insurance. It is illegal for contractors to cover that payment. The rest of the project is paid for by the insurance check. If you want to upgrade your roof with anything not covered by insurance, we will create a payment plan that works for you.

Once funds are collected, we can begin work on the full restoration. We will keep you in the loop on your project and you will have a dedicated Project Manager every step of the way. Once the project is complete we pick up our tools and leave the property as good as new.

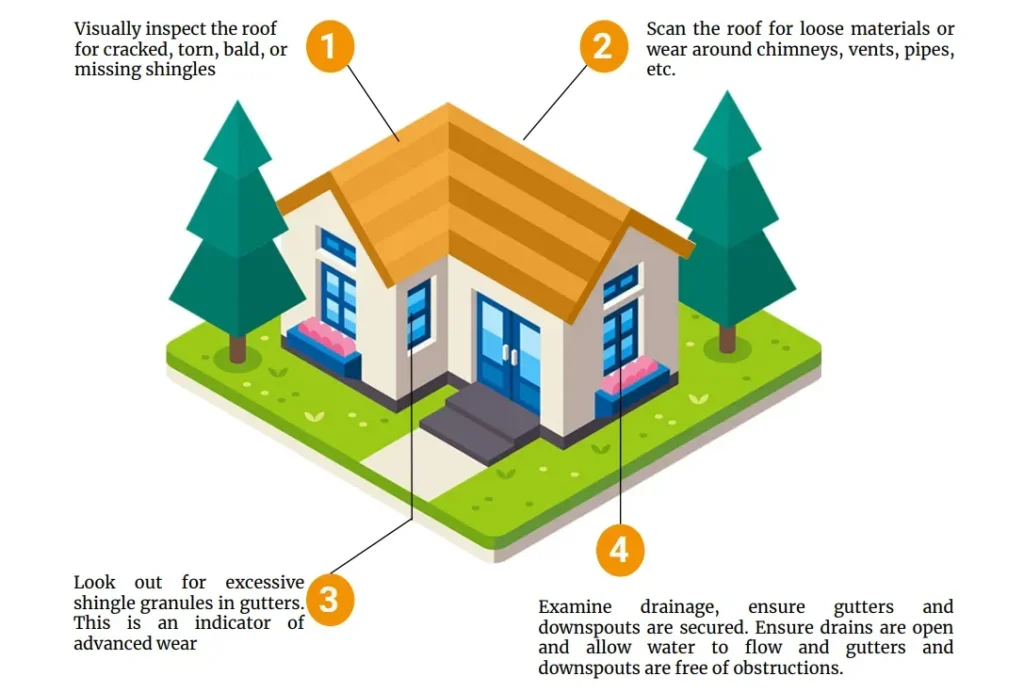

Roof Inspection

It’s not always easy for homeowners to tell when they need a new roof or urgent roof repairs. It’s important to note these key indications that suggest roof repairs are required. If the roof has experienced heavy storm damage, you may need to question whether the roof needs to be totally replaced.

Other Signs of Damage

- Tiles or shingles that are missing, loose or worn

- Excessive rust or gaps in metal roof seams

- Worn coatings or membranes on commercial roofs

- Loose or missing flashing, especially around chimneys or vents

- Granules from shingles collecting in gutters

- Inadequate or blocked ventilation

- Discoloration of roofing shingles or panels

- Mold growth

- Punctures or tears

- Stains on exterior walls

- Stains on the underside of the roof decking

- Loose, gapped or leaking gutters

- Blocked downspouts

Signs of Damage

HAIL BRUISING

SHINGLE CURLING

MISSING SHINGLES

Adjuster Meeting

After the claim is submitted, the insurance company will usually send out their own representative to verify the damage. This representative will perform their own inspection of the roof. It’s important to be present for this meeting to answer any questions and for the contractor to attend as well to make sure the inspection is done thoroughly.

Before the Meeting

It is recommended that the contractor attend the field adjuster meeting. The contractor will review the following for you before the meeting:

➤ Review the inspection report, photos, measurements and the estimate. You should be an expert on the case.

➤ Review local code, those items are supposed to be automatically covered for upgrade.

Adjuster Inspection

The goal of the meeting is to observe the inspection and be there to answer any questions that may come up. We want to have a positive and respectful experience with the adjuster.

➤ Introduce yourself to the adjuster and make sure to get their contact information.

➤ Remember to update the adjuster with some of the case information, like date and type of loss.

➤ The contractor will get on the roof with the adjuster but give them space to review and do their inspection. Take notes of their comments and any approvals.

Claim Decision

CLAIM APPROVAL

➤ If the process is followed through correctly and the claim is filed in good faith, you should get a full approval.

➤ Distribution: If you have a mortgage on the home, the funds need to be distributed through the mortgage company.

➤ It’s time to pay the deductible and start the job. The insurance company will send a check to cover the rest of the approved project.

CLAIM DENIAL

➤ Even when accurate evidence is provided, there is a chance of denial or just partial approval.

➤ It is not the end! Homeowners have the right to call their insurance company and ask for a 2nd adjuster inspection.

➤ It is important to mitigate the damage as soon as possible. While the claim is getting negotiated, you may want to finance the project to get repairs done sooner.

Choose the Right Contractor

➤ Watch out for unsolicited offers or contractors claiming they can perform repairs at a discount with leftover supplies from another job

➤ Verify a roofing contractor has a license with local and state licensing boards (if your state requires it)

➤ Check for proof of insurance and verify with the insurer that their policy is current

➤ Never pay the full amount of a repair upfront and hesitate before providing large deposits

➤ Read the entire contract, including the fine print, before signing to ensure it includes the required buyer’s right to cancel language. Understand cancellation rights and penalties you may experience for canceling

➤ Do not sign a certificate of completion or make final payment until you are satisfied with the work performed

The Job Begins

When the work is approved and the deductible is paid, the contractor will begin work. Here are some things to keep in mind to prepare your property for the roofing job.

Please walk around the exterior of your home and take any valuables inside and store them somewhere safe.

Clear or remove anything that may be in your driveway so we have a clear work area. Remember to also move deck table/chairs, solar lights.

Warning! It may get messy when we are installing your roof but before we leave the entire job site will be clean.

If you have any pets please keep them indoors or somewhere safe for the days that we are working.

After underlayment is installed typically there will be a couple inspections. Then the roof is installed followed by a final inspection.

Do not drive into driveway when work is in progress (there may be stray nails).

Remove ALL valuables and pictures from walls that may fall during the heavier parts of installation.

If possible mow lawn a few days before we arrive (makes finding debris easier with shorter grass).

NEED MORE INFORMATION?

Frequently Asked Questions

What should my first steps be?

If your home has been damaged or destroyed, you are likely to feel overwhelmed by the loss and by the repair, replace and recovery process that lies ahead. If your property was insured, that insurance policy is the best vehicle to get you back home. If this is your first experience with a large insurance claim, recognize that it’s basically a business

negotiation.

When it comes to insurance lingo, laws and construction estimating… you’re not on a level playing field with the experienced insurance company. But although you may be unfamiliar with your policy and the process in general, there are laws and rules that give you rights. Use them to negotiate and recover the full benefits you’re entitled to under the policy you paid for.

Will you cover my deductible?

No, we will not cover your deductible. Roofing contractors who say they will cover the deductible are committing insurance fraud. We pride ourselves in being honest and fair with all of our customers and therefore we do not compromise on our ethics.

Do I need bids from other contractors?

No, you do not need to get more than one estimate. As the homeowner you can choose the contractor you want to do the repairs. Your insurance company may suggest to get more than one estimate, however, if you get multiple estimates your insurance company will most likely go with the cheapest estimate and not the best quality option.

How can I get a fair settlement?

If you’re like most people, your home is your biggest asset. Insurance companies often read their policies with a bias that is too much in their own favor. Don’t accept an insurance company’s calculation of what they owe on your claim without getting other opinions.

Do you follow price guidelines?

The insurance company will only pay according to its “pricing guidelines” but they don’t match what local contractors are charging —what can I do? Computers don’t repair and build homes… licensed contractors do. Your insurance company owes you for what an experienced and reputable contractor would charge you to do the required work to put your home back to its pre-loss condition. Insurance companies use guideline pricing and “Xactimate” (computerized home replacement cost estimating software) to predict how much materials and labor should cost. But an estimate prepared by a qualified local, licensed and bonded contractor who has visited the loss site and reviewed information about the pre-loss structure is generally the most reliable basis for a claim settlement.

let’s connect TODAY

SEND A MESSAGE TO OUR TEAM

Fill out the contact form below, and a member of our team will reach out as soon as possible.